foreign gift tax india

Money received without any consideration. Regarding the latter as of 2019 you will need to file Form 3520 if youre a US.

Property Sale By Nri In India Tax Tds Rebate Repatriation Rbi Approval

If you are given money from a non-US citizen as a gift however you do need to declare it on Form 3520 if it is over 100000 in value.

. However the Gift Tax Act was abolished in 1998 and thus all gifts were made tax free. The Gift Tax was introduced in India in 1958 and got abolished in 1988 after which all gifts were tax free. Person other than an organization described in section 501c and exempt from tax under section 501a of the Internal Revenue Code who.

Tax ramifications on the initial receipt of a gift from a. All immovable property assets like land. The budget speech by the Honble Finance Minister notes.

In case someone sends you money from India to the US as a gift or inheritance you might need to report it to the IRS as a foreign gift on Form 3520 this is done with your US tax. Citizen and you received 100000 or more from a nonresident alien individual or foreign estate. 30000 is put to tax 30.

Person from a foreign person that the recipient treats as a gift and can exclude from gross income. The IRS Reporting of International Gifts is a very important piece in the Offshore Compliance puzzle. Person who received foreign gifts of money or other property you may need to report these gifts on form 3520.

International Tax Gap Series. The IRS defines a foreign gift is money or other property received by a US. Foreign Gift Tax India.

Gifts worth more than Rs. You will not have to pay tax on this. Gifts of immovable properties situated outside India.

Accordingly finance act 2019 no. Person gives a gift that exceeds the annual exclusion amount they typically must file a Form 709 unless an exception or exclusion. Person receives a gift from foreign person and the value of gift exceeds either the individual foreign person or entity foreign person threshold the gift.

Even though there are no US. Foreign Gift Tax the IRS. If you are a US.

The entire amount in cash received as a gift. In 2004 the Government re-introduced the concept of taxing gifts under the Income Tax. Indias budget of 2022-23 has come bearing a unique giftof allowing world class foreign universities in the Gift City.

What Is The Capital Gains Tax On Gifted Property Sold In India

New Tax Rules On Foreign Remittances Explained

Invest India On Twitter Indiaresurgent Here Are The Tax Incentives Announced In Budget2021 For The Companies Located At The International Financial Services Centre Ifsc In Gujarat S Giftcity Thelionroarsagain Unionbudget2021 Cmoguj Https

Gift By Nri To Resident Indian Or Vice Versa Taxation And More Sbnri

Mobility Insights Listing Expatorbit

Corporate Tax Rates Around The World Tax Foundation

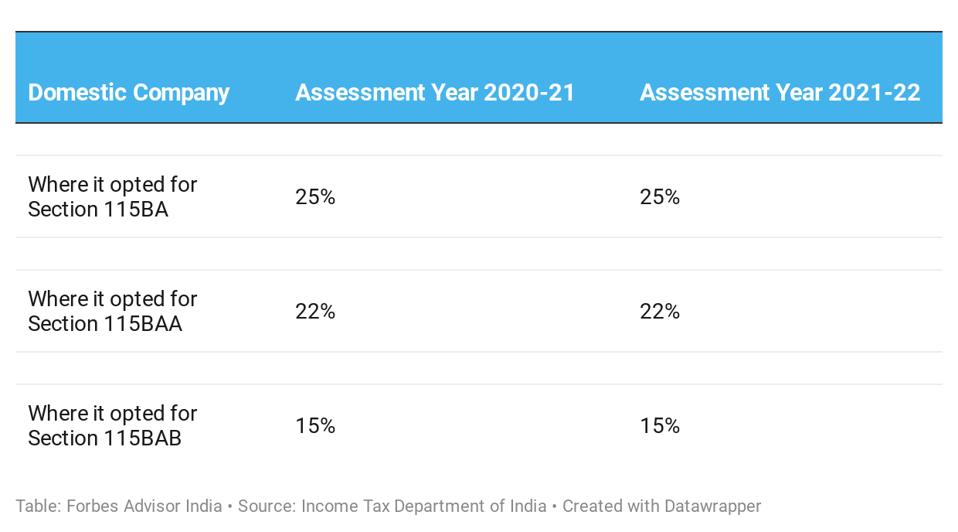

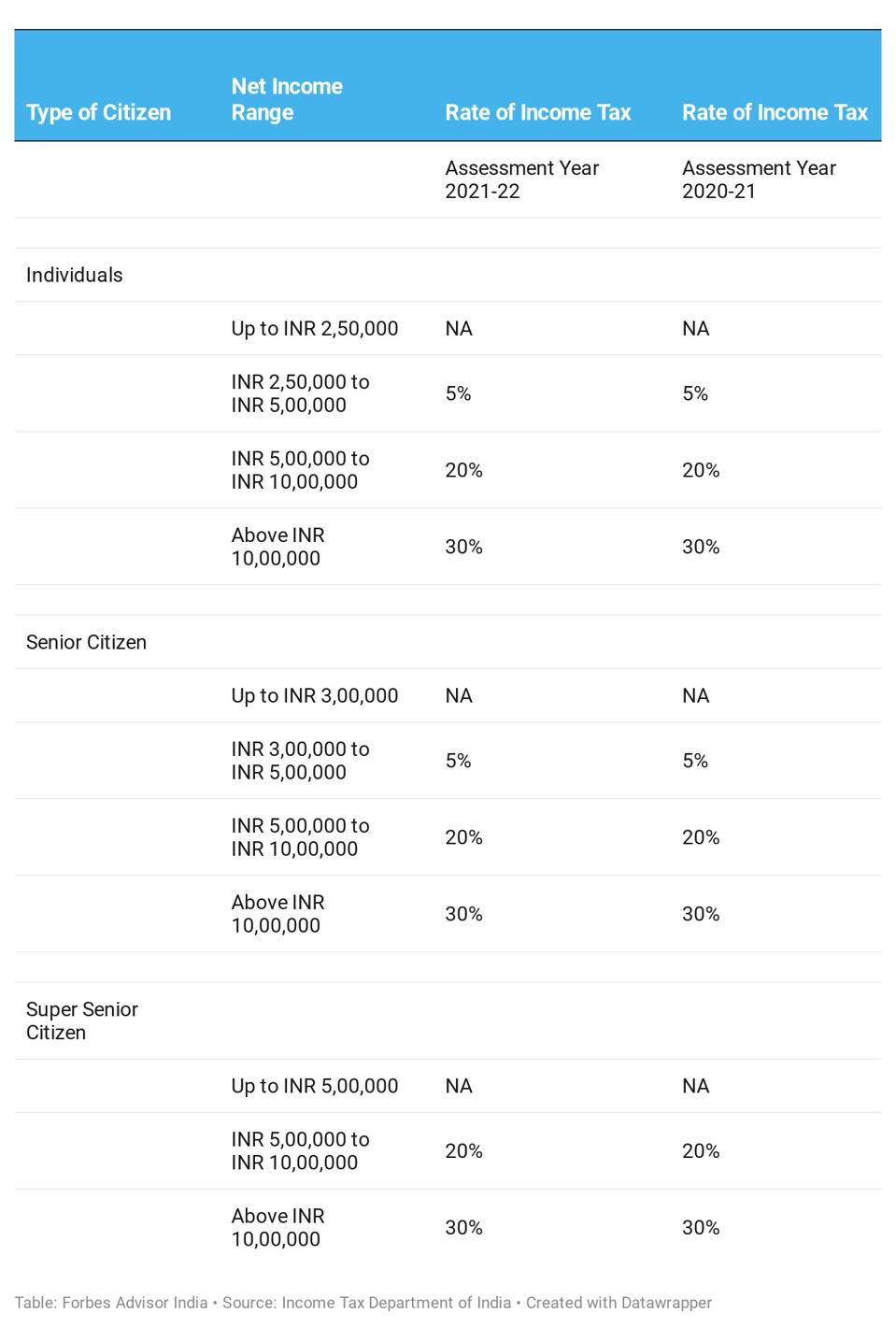

Know Types Of Direct Tax And Charges Forbes Advisor India

Corporate Tax Rates Around The World Tax Foundation

Customs Taxes I Will Be Carrying A 32 Tv To India From A Foreign Country How Much Tax Do I Pay Read Details Below R India

Did You Receive Gift Tax Implications On Gifts Examples Limits Rules

Gift By Nri To Resident Indian Or Vice Versa Nri Gift Tax In India

Sending Gifts To Children Relatives Abroad You May Have To Pay Tax The Financial Express

What Is The Gift Tax In India And How Does It Affect Nris

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

How Are Gains On Foreign Stock Investments Taxed Forbes Advisor India

Nri Selling Inherited Property In India Tax Implications 2022 Sbnri

Gift From Nri Dad Not Taxable But You Have To Pay Tax On Income From It The Financial Express