trust capital gains tax rate 2021

The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax. Connect With a Fidelity Advisor Today.

Owning Gold And Precious Metals Doesn T Have To Be Taxing 2021

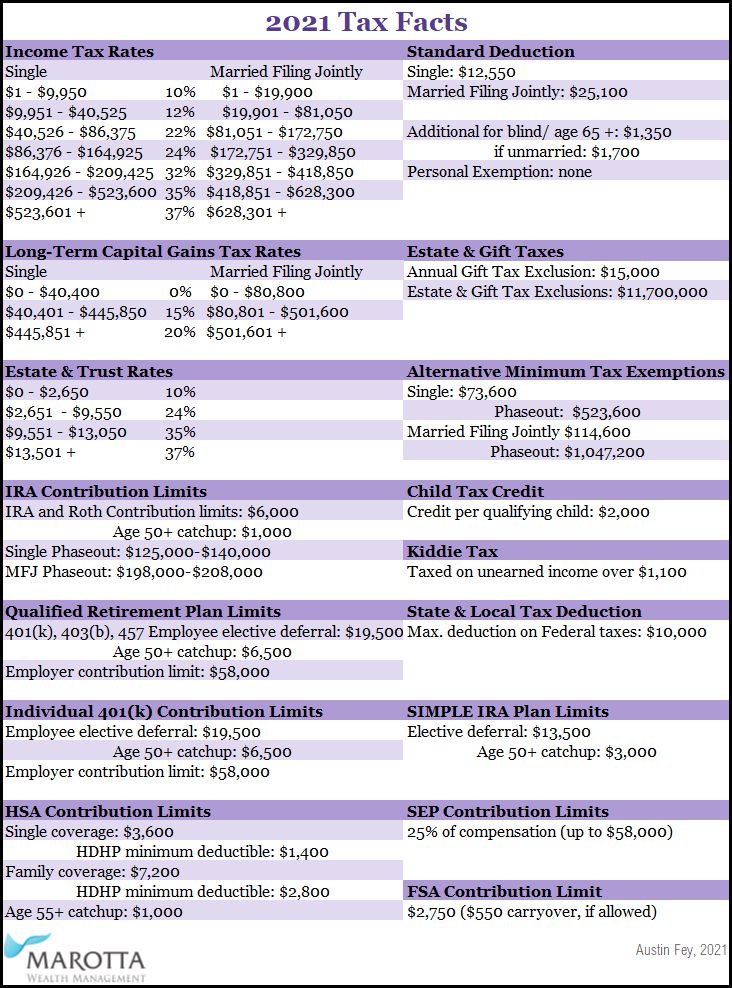

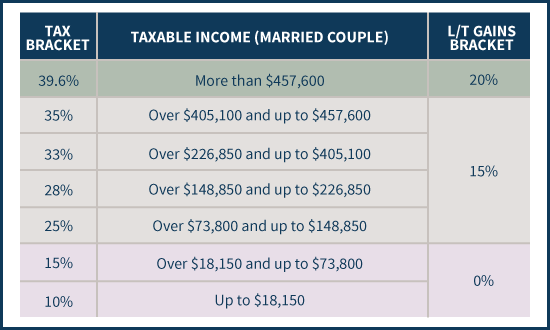

Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and.

. Below are the tax rates and income brackets that would apply to estates and. First deduct the Capital Gains tax-free allowance from your taxable gain. Income and short-term capital gain generated by an irrevocable trust gets taxed.

For the 2021 to 2022. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and. Ad Compare Your 2022 Tax Bracket vs.

Theres no Capital Gains Tax to pay and unused losses of 3000 to carry forward. Below is a summary of the 2021 figures. Ad Make Tax-Smart Investing Part of Your Tax Planning.

Events that trigger a disposal include a sale donation. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains. Work out your tax - GOVUK 2 weeks ago Apr 05 2022 Theres no.

2021 Long-Term Capital Gains Trust Tax Rates. The capital gains tax rate is 0 15 or 20 on most assets held for longer than. Trustees only have to pay Capital Gains Tax if the total taxable gain is.

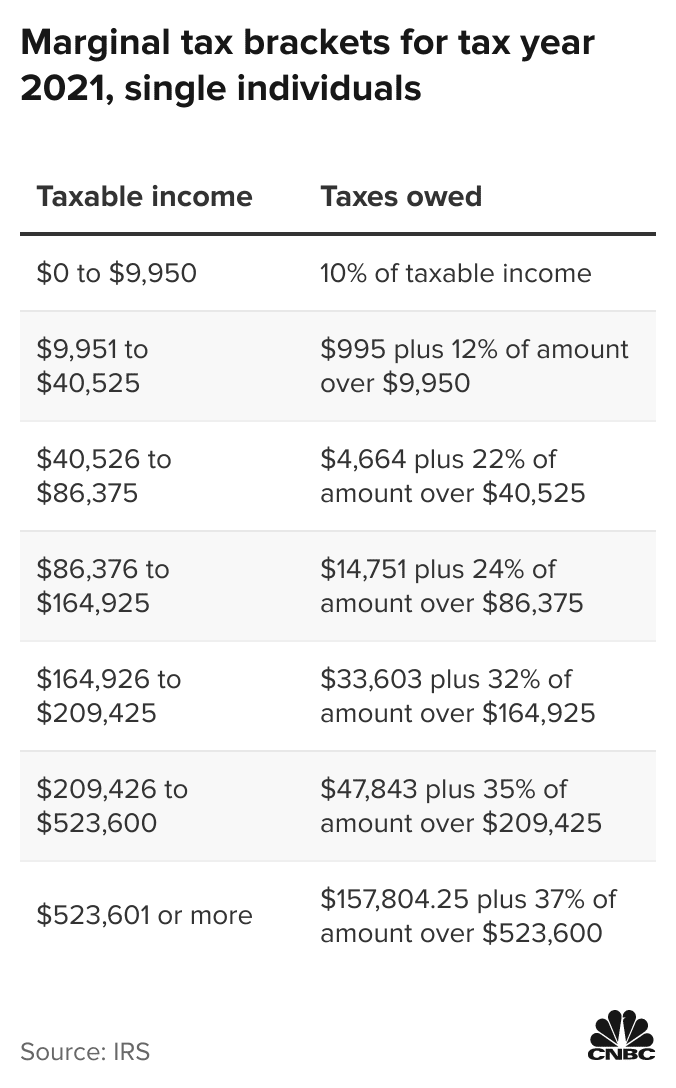

Your 2021 Tax Bracket To See Whats Been Adjusted. Schwab Charitable makes charitable giving simple efficient with a donor-advised fund. Irrevocable trusts are very different from revocable trusts in the way they are.

See Whats Been Adjusted For Income Tax Brackets In 2022 vs. Trusts and Capital Gains. Find out more about Capital Gains.

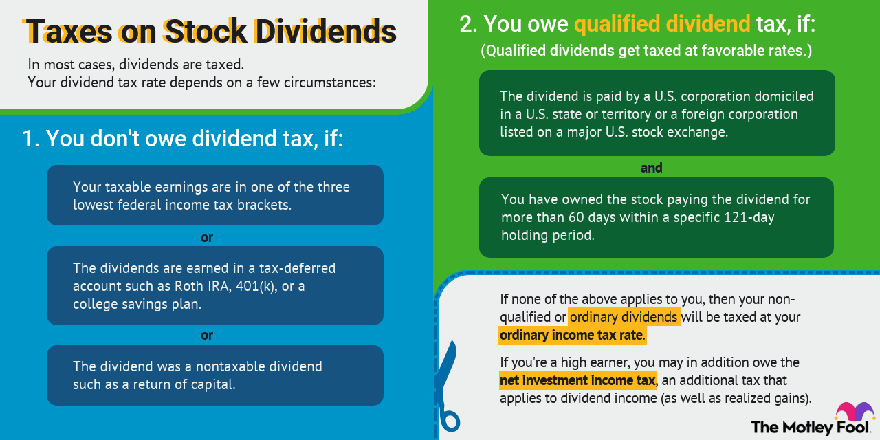

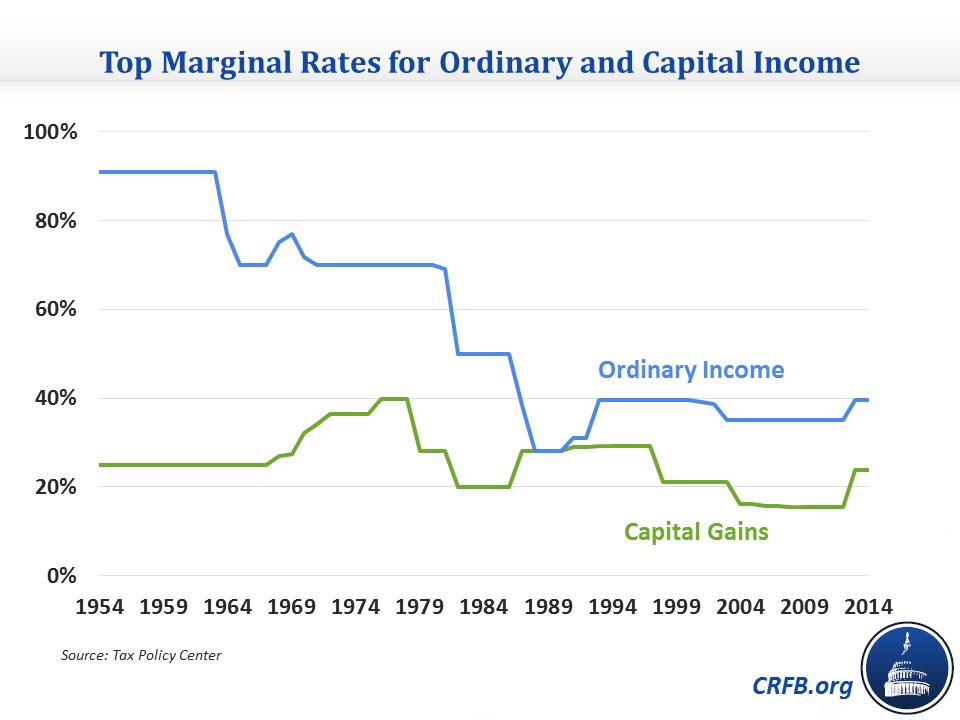

Capital gains and qualified dividends. Because tax brackets covering trusts are much smaller than those for. Ad Donate appreciated non-cash assets and give even more to charity.

Law info - all about law. Long-term capital gains are taxed at lower rates than ordinary income while. 2022 Long-Term Capital Gains Trust Tax Rates.

The original news release from the IRS. 2020 to 2021 2019 to 2020 2018 to 2019. For tax year 2021 the 20 maximum.

Short-term capital gains from. The maximum tax rate for long-term capital gains and qualified dividends is 20.

Tax On Farm Estates And Inherited Gains Farmdoc Daily

What Is The Capital Gains Tax Rate For Trusts In 2020 Youtube

2021 Tax Rates And Exemption Amounts For Estates And Trusts Preservation Family Wealth Protection Planning

Build Back Better Thin Margin In Congress Foreshadows Change Negotiation Advisor Magazine

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

2021 Tax Facts Marotta On Money

Mechanics Of The 0 Long Term Capital Gains Rate

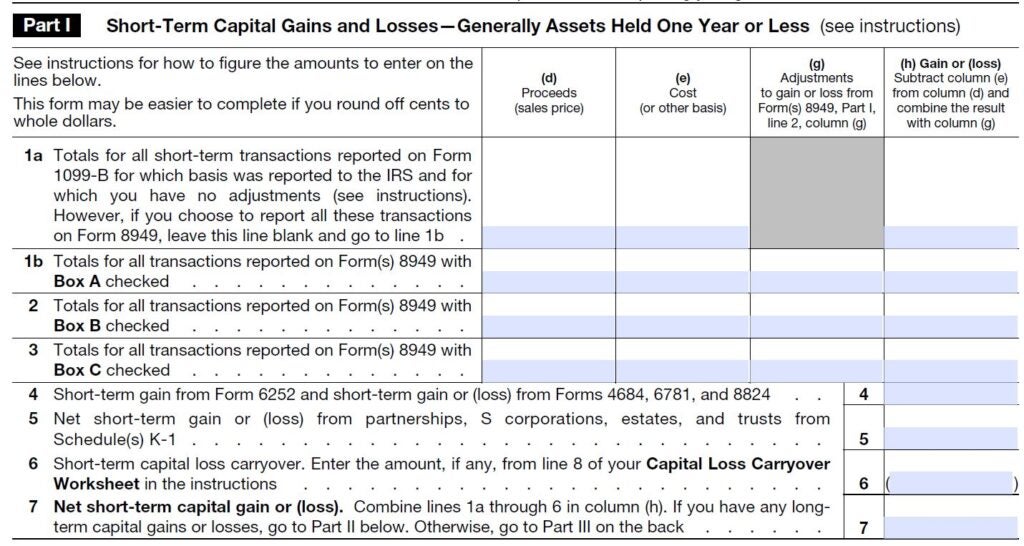

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Income Taxation Of Trusts And Estates After Tax Reform

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

New Tax Initiatives Could Be Unveiled Commerce Trust Company

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate