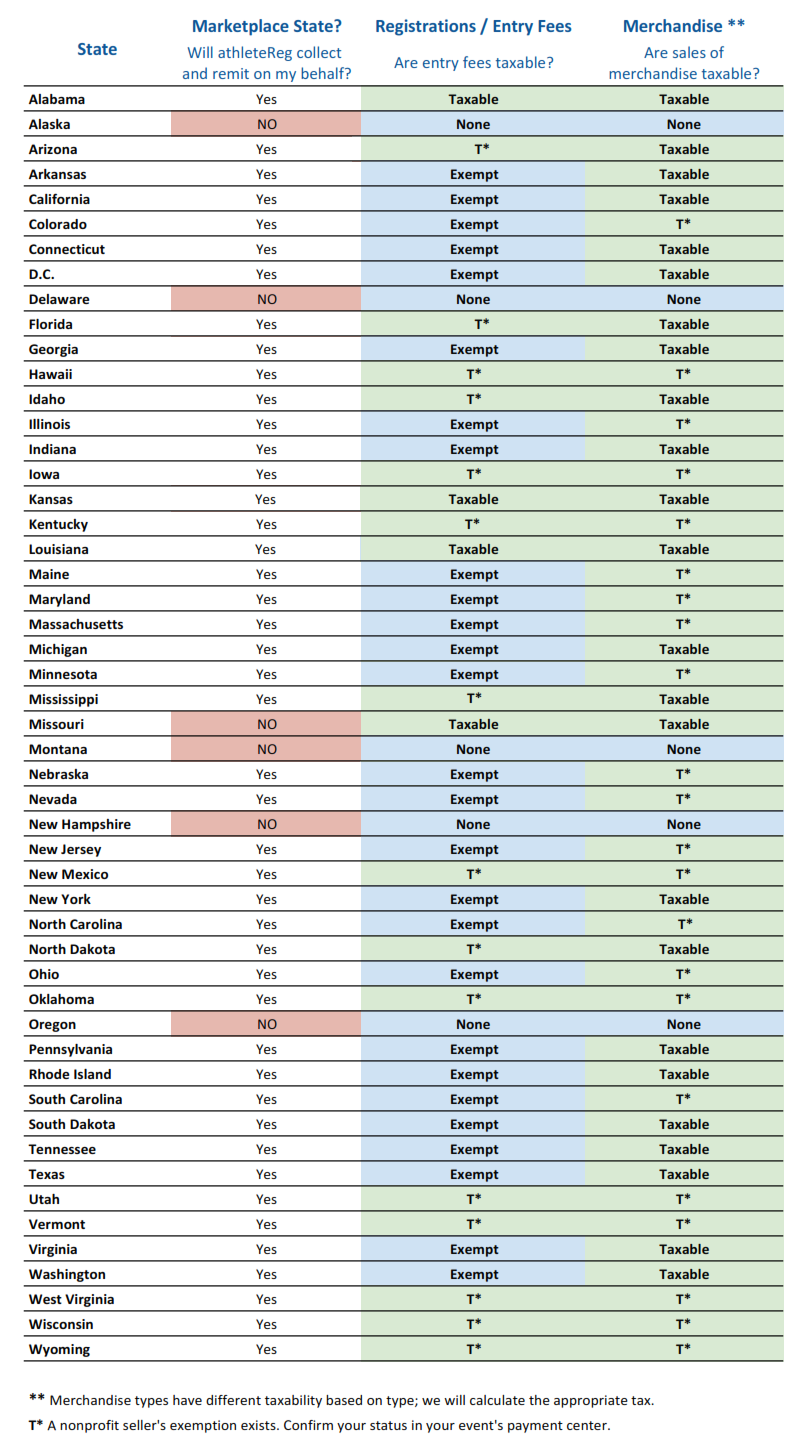

michigan sales tax exemption nonprofit

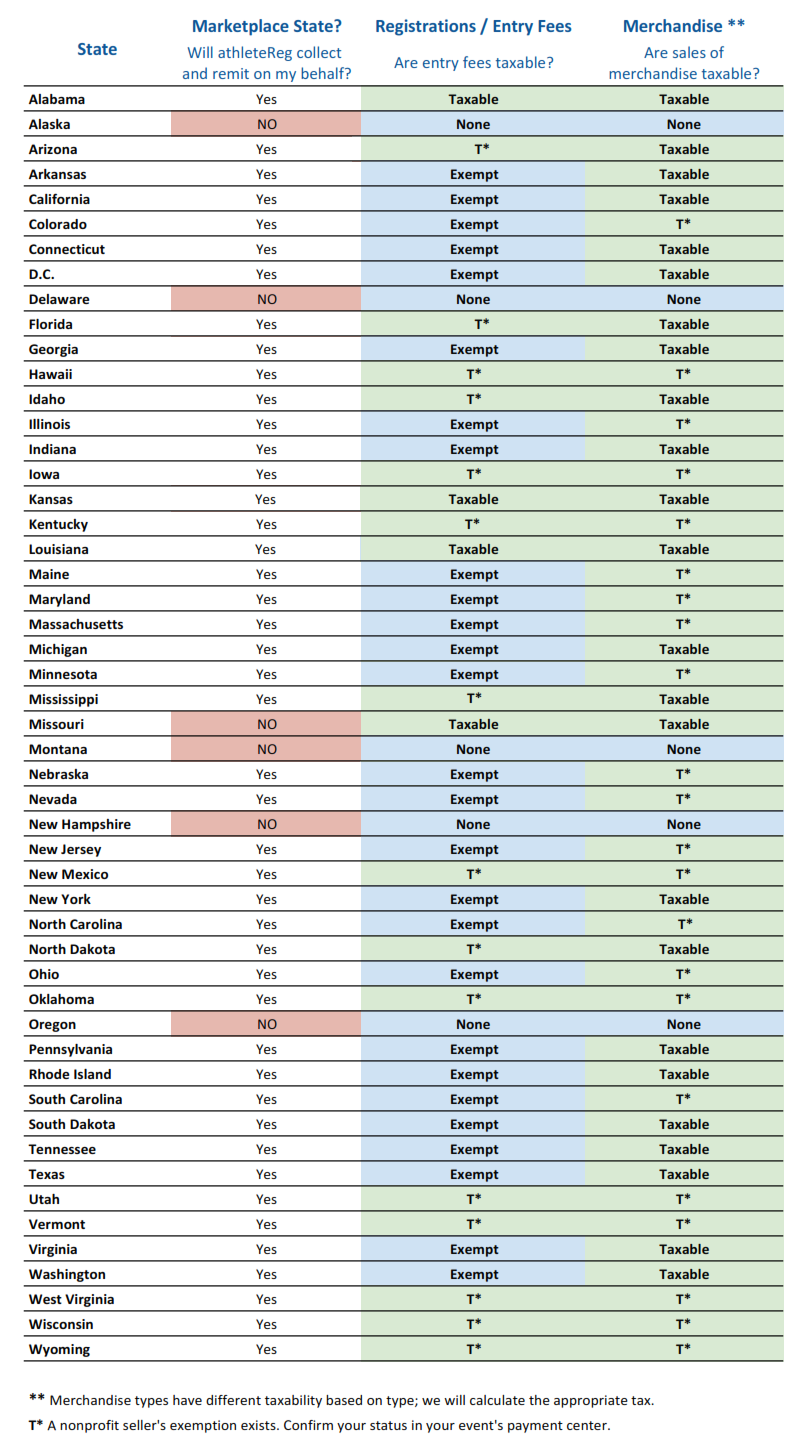

Notice of New Sales Tax Requirements for Out-of-State Sellers. When completing a sales tax exemption certificate a nonprofit should be certain to complete the form in full and avoid an simple mistakes that may delay processing.

Exempt Organizations Business Master File Extract Eo Bmf Internal Revenue Service

CityLocalCounty Sales Tax - Michigan has no city local or county sales tax.

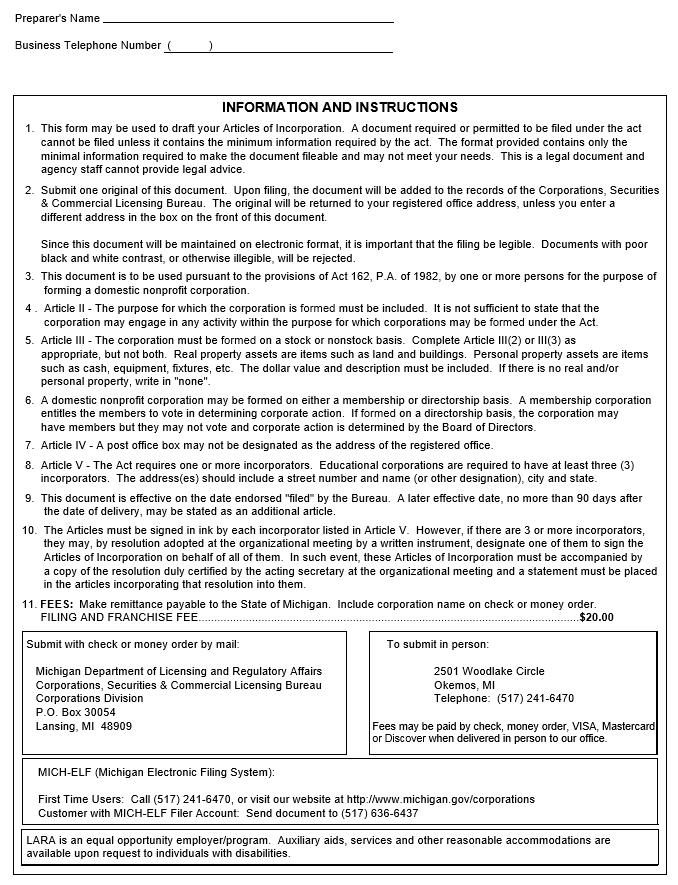

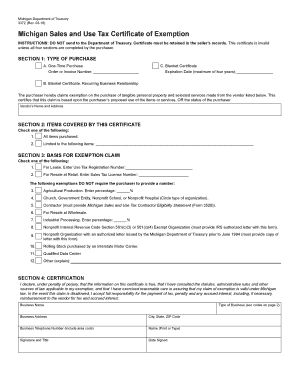

. Purchasers may use this form to claim exemption from Michigan. Michigan Sales and Use Tax Certificate of Exemption INSTRUCTIONS. All fields must be.

Once your organization receives your 501c determination letter from the IRS it will automatically be. Some nonprofit entities were issued an exemption. A completed Form 3372 Michigan Sales and Use Tax Certificate of Exemption.

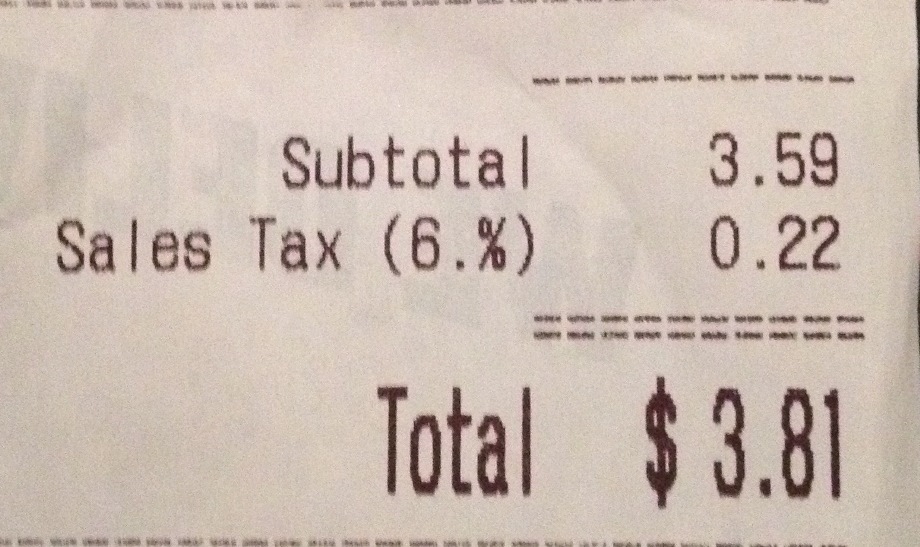

While the Michigan sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. Various exemptions from sales and use tax may be available when selling or leasing. This page discusses various sales tax exemptions in Michigan.

Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. There is a Michigan Sales and Use Tax Certificate of Exemption form that you may complete and give that form to your vendors making a claim for exemption from sales or use tax. Nonprofit Organizations with an Exempt letter from the State of.

Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. For transactions occurring on and after October 1 2015 an out-of-state seller may be. However if provided to the purchaser in electronic.

An exemption from sales. Nonprofit Internal Revenue Code Section 501c3 and 501c4 Exempt Organizations Attach copy of IRS letter ruling. 07 Retail 15 Non-Profit 501c3 or 501c4 08 Church.

It is the Purchasers. Many kinds of transactions are exempt from the sales tax such as sales to nonprofit organizations churches schools farmers and industrial processors. Most charitable nonprofits must also file with the Attorney Generals.

The state sales tax rate is 6. Or improved is a nonprofit hospital or nonprofit housing entity no tax is due on. State income tax exemption.

Apply for exemption from state taxes. Streamlined Sales and Use Tax Project. In order to claim exemption the nonprofit organization must provide the seller with both.

Any questions please contact the Michigan Department of Treasury Sales Use and Withholding Tax office 517-636-6925. DO NOT send to the Department of Treasury. Whether your nonprofit operates in one or multiple states obtaining exemptions from income franchise sales and use taxes can consume a great deal of a nonprofits staff time and.

Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on. Nonprofit Entity Letters. A copy of the federal exemption letter or a letter previously issued by this department must accompany a completed Michigan Sales and Use Tax Certificate of Exemption form 3372.

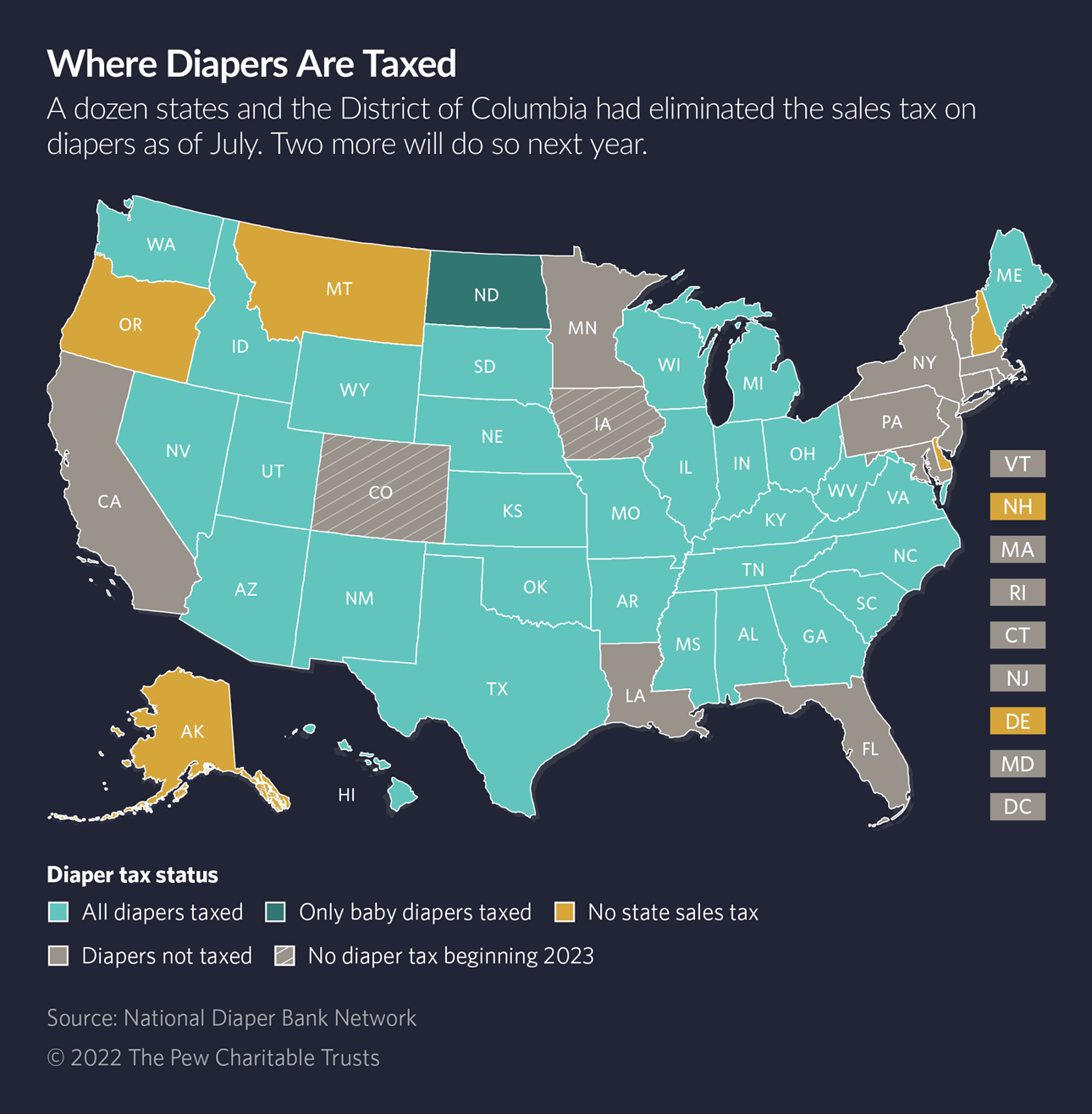

As Prices Rise The Push To End Diaper Taxes Grows Maryland Matters

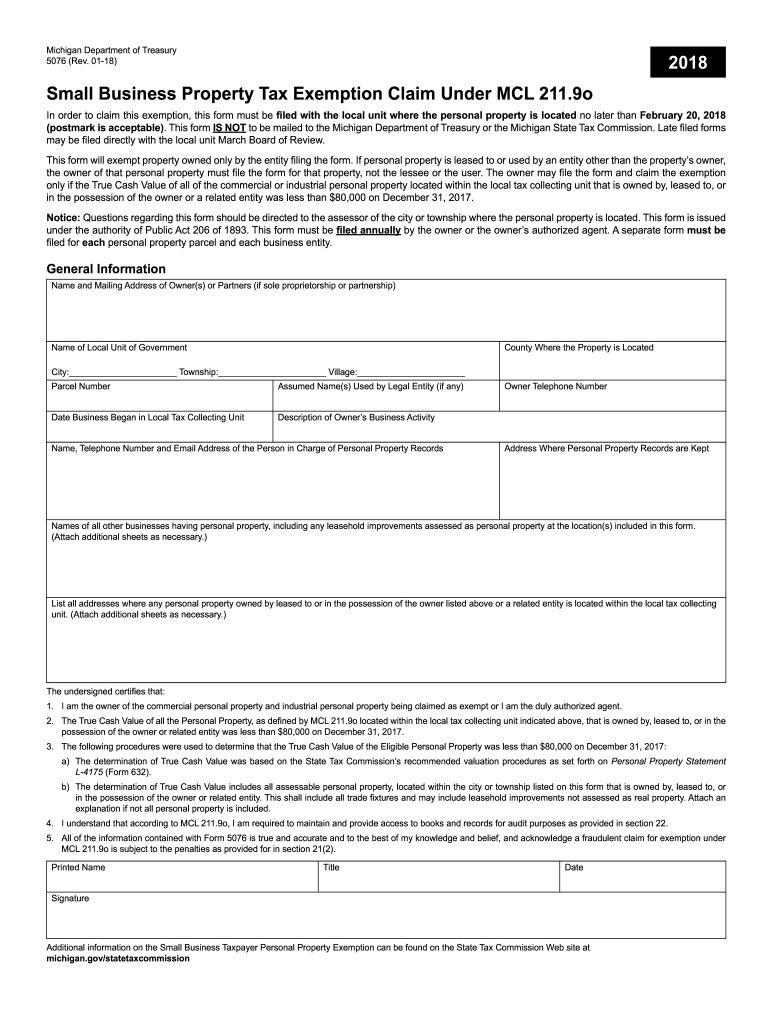

Small Business Property Tax Exemption Claim Under Mcl 211 Fill Out Sign Online Dochub

If Sales Tax Is Passed Michigan Would Have The Second Highest In The U S Michigan Capitol Confidential

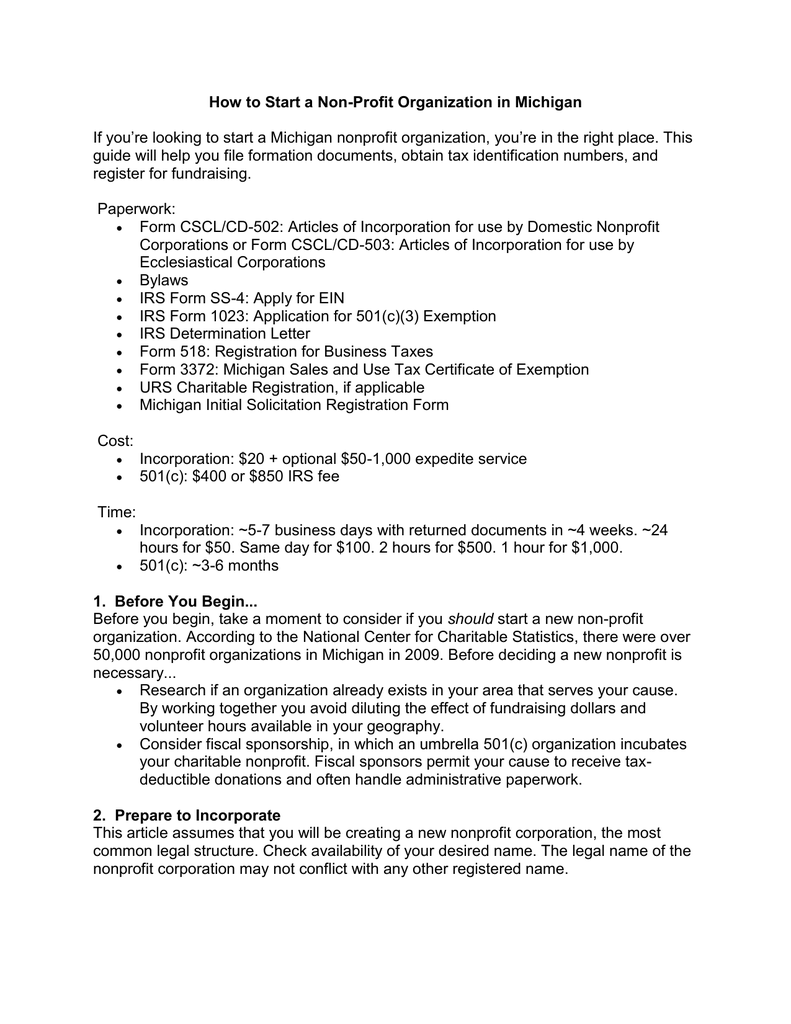

How To Start A 501c3 In The State Of Michigan

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Tax Exemption Guidelines Newegg Knowledge Base

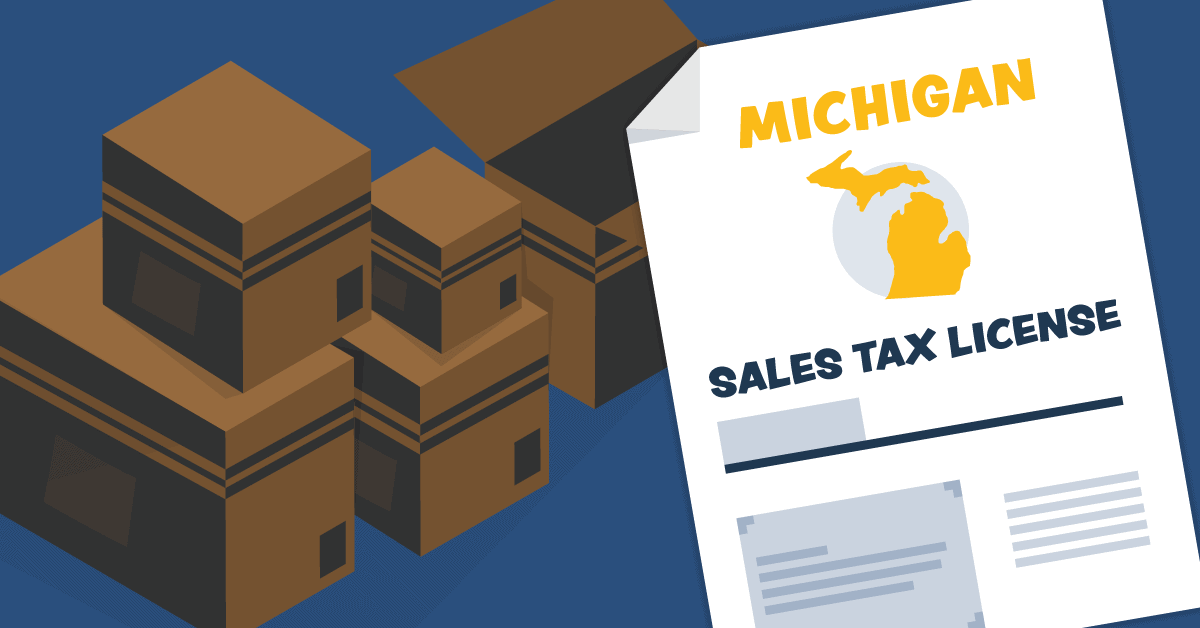

Free Michigan Articles Of Incorporation For Use By A Nonprofit Corporation Form Cscl Cd 502

How To Get A Sales Tax Certificate Of Exemption In Virginia Startingyourbusiness Com

Mi Sales Tax Exemption Form Animart

How To Keep Your Michigan Nonprofit Compliant Truic

Michigan Sales Tax License Northwest Registered Agent

How To Start A Nonprofit Step By Step

Bikereg Com Online Cycling Event Registration

American Legion Department Of Michigan Ppt Download

Michigan Certificate Of Tax Exemption From 3372 Fill Out Sign Online Dochub

Nonprofit Regulation In Michigan Ballotpedia

How To Start A 501c3 In The State Of Michigan

Resale Certificate Michigan Form Fill Out And Sign Printable Pdf Template Signnow

Do Arizona Nonprofit Organizations Pay And Or Collect Sales Taxes Asu Lodestar Center For Philanthropy And Nonprofit Innovation